New study by Community Savings shows BC facing ‘RESP gap’ between low and high income families

Amidst increasing inflation, 79% of BC parents who don’t have an RESP cite financial barriers to opening government-offered Registered Education Savings Plans

With only 51% uptake of RESPs among low-income BC households, the total cost to BC children missing out on free government grants and the opportunity to earn interest is over $280M

Key findings

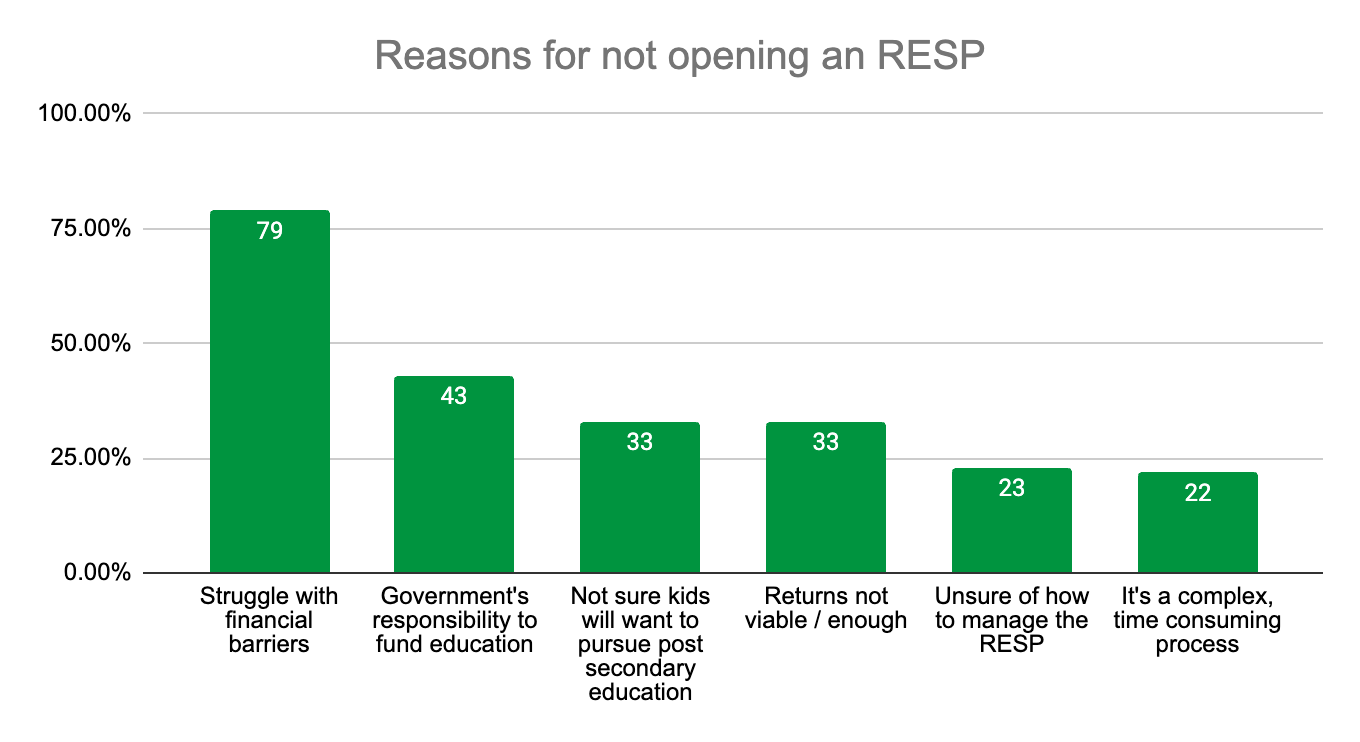

- Affected by high costs of living, 79% of parents who don’t have an RESP cite financial barriers as the main challenge for not opening an account.

- High-income households are more than 50% likely to have an RESP for their child than low-income households.

- Study shows awareness is high for RESPs at 97%, but uptake is challenged by the squeeze on household budgets.

- The unintended consequence of low RESP uptake means children from lower income households miss out on the free BC Training & Education Savings Grant and the free Canada Learning Bond - which serves to further increase the wealth gap for BC children.

- Among those BC parents who have an RESP, 3 in 5 agree that the government should provide funding for every child regardless of RESP account set up.

September 06, 2023, Vancouver / Unceded Territories of the Musqueam, Squamish and Tsleil-Waututh Nations - Faced with higher costs of living, new data released today shows how BC parents are being challenged by financial pressures and struggle to open or contribute to Registered Education Savings Plans (RESPs).

The research, by Community Savings Credit Union, conducted among members of the Angus Reid Forum, looks at how 810 BC parents are saving for their child’s higher education. The research assessed understanding of education savings, and the motivators and barriers that influence uptake of RESPs.

An RESP is a government-offered long-term savings plan that helps parents save for their child’s education after high school. As high as 79% of BC parents without an RESP cite financial barriers as the top reason for not opening an account. With a 5.6% increase in Consumer Price Index this July in BC , parents are feeling the pinch in household budgets.

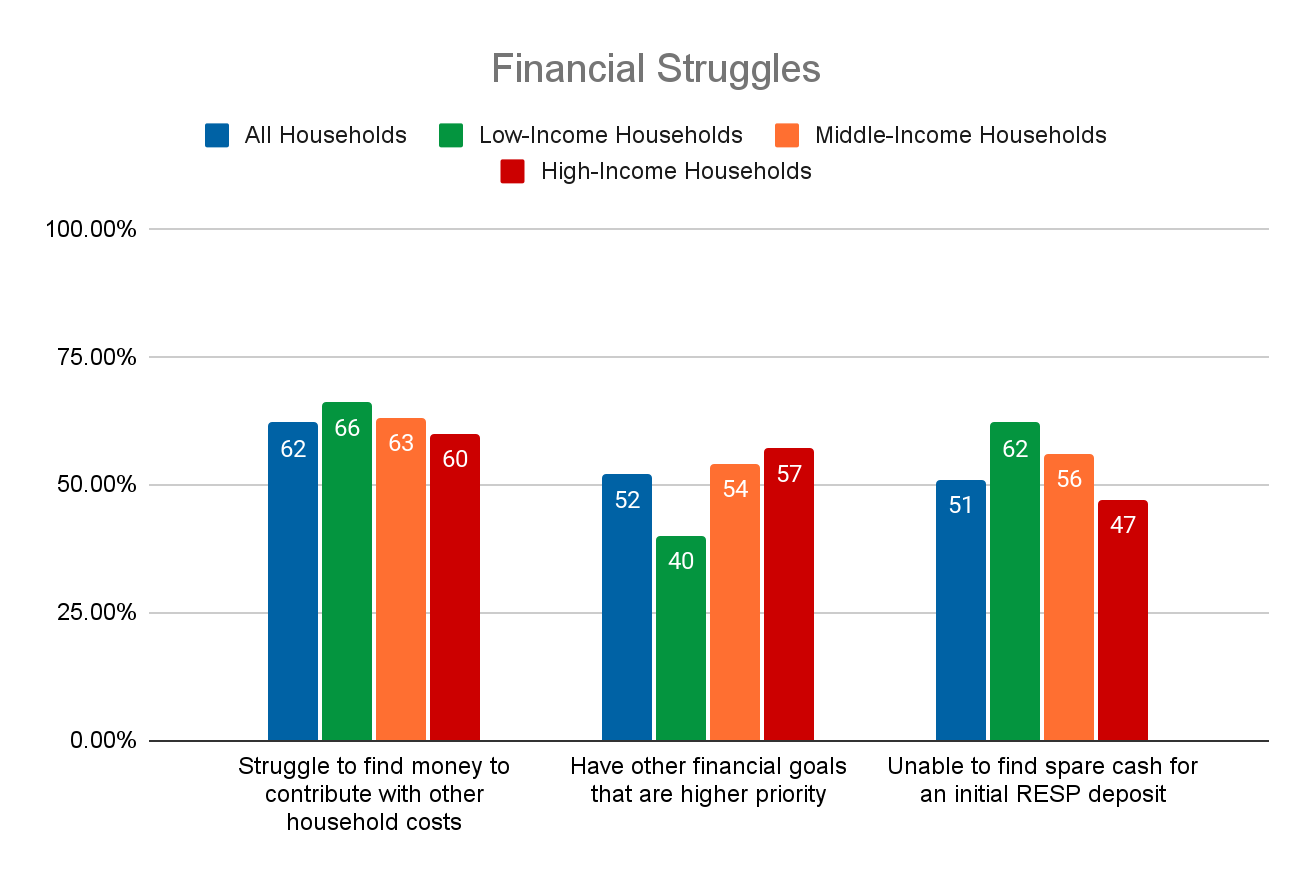

The financial barriers cited by 79% of all polled BC parents without an RESP are even more challenging for low-income households. The likelihood of low-income BC parents to have an RESP for their child (51%) is much lower than high-income parents (78%). 62% of BC parents without an RESP say they are unable to find spare cash for an initial deposit. Almost 9 in 10 low-income parents state they are financially challenged, making it unaffordable to contribute towards an RESP for their child.

The ‘RESP gap’ is an issue because BC children from low-income households are missing out a combined $280M in free government grants and interest towards their education.

The BC government requires an RESP for the free BC Training & Education Savings Grant, a one-time $1,200 grant, and the federal government requires an RESP for the needs-based Canada Learning Bond, a grant of up to $2,000. Without an RESP, children from low-income households are missing out on what could be over $5,000 of funds to support their education when they graduate (with interest). This research shows that 3 in 5 BC parents with an RESP account want the government to improve education savings policy and provide these funds regardless of an RESP account set up.

Low RESP uptake and low contributions to RESPs will have a disproportionate impact on BC’s children from non-affluent households to pursue post-secondary education. The RESP gap continues to contribute to BC’s wealth gap - data shows children are less likely to attend any post-secondary education if they do not have an education savings account.

Commenting on the findings of the survey, Mike Schilling, President and CEO of Community Savings Credit Union, said “Our data shows that the cost of living in BC is leading parents to make an unfair choice between saving for education and other financial priorities. The RESP divide is unjust. There is a government benefit that isn’t reaching families that need it most. We are advocating for better policy so that families of all income levels can take advantage of free government education contributions.

“The best thing parents can do is open a free RESP, even without an initial deposit. Community Savings Credit Union is stepping in to provide all parents with an initial $200 contribution for every RESP opened. We are here to help parents create a savings plan for RESPs that will pay dividends for their children’s futures”, Mike added.

Community Savings Credit Union is providing parents with an initial deposit bonus of $100 for every RESP account set up, and an additional $100 if the account opener joins Community Savings Credit Union as an active member. There is no minimum RESP deposit required.

To learn more about RESPs, visit: www.comsavings.com.

Case study

If a low-income household opens an RESP when their child is 1 with the free $200 contribution from Community Savings Credit Union, and the free Canada Learning Bond of $500, and receives yearly $100 Canada Learning Bond contributions and the free BC Training & Education Savings Grant for their child at age 6 - at 18, their child will have $5,450.52* towards their education, with no contributions required.

*(Based on current Community Savings Central 1 interest rates of 4% interest with a 12 or 24 month deposit. Calculations based on an assumed 4% interest rate - current term deposit rates and associated rates of return are not indicators of future returns, as interest rates will fluctuate.)

DETAILED FINDINGS

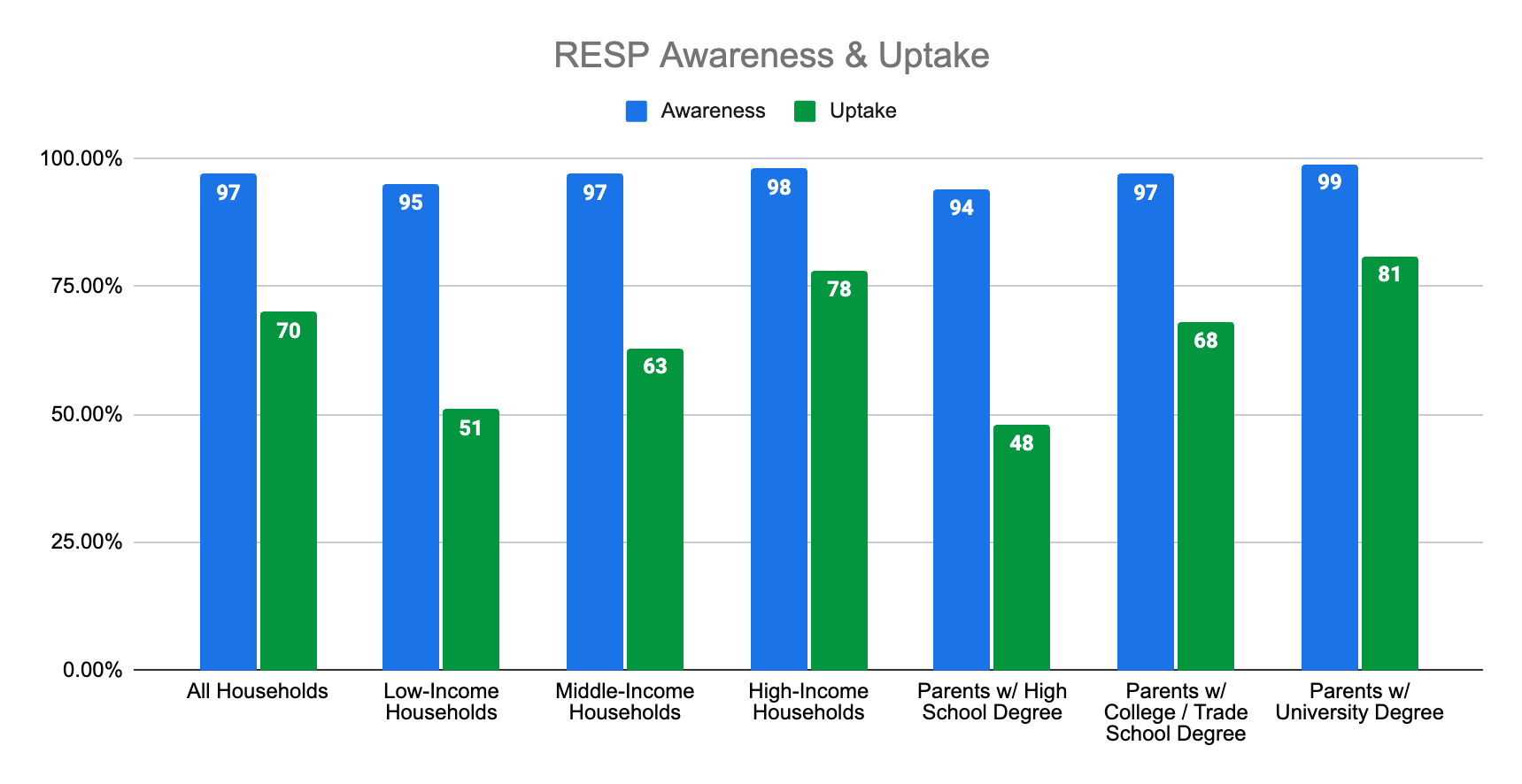

- 97% of BC parents are aware of RESPs but uptake staggers at 70%; what is the underlying problem?

- In a positive, the survey finds that 97% of BC parents are aware of RESPs and its benefits. However, only 70% actually own and invest in one for their child’s education

- Evidently, high-income households with over $100,000 income are more than 50% likely to have an RESP for their child, resulting in 78% uptake. In comparison, low-income households with earnings under $50,000 trail significantly behind at a rate of 51%

- Notably, the median household income in BC is between $70,000 to $80,000. Within this economic bracket, 63% of respondents have RESPs for their child, much lower than those with high incomes

- This divide deepens as those with a university degree are even more likely to have an RESP for their child at a rate of 81%. In contrast, those with just a high school diploma are comparatively much less likely (48%) to open an account.

- The disparity in access to educational savings instruments continues the education and wealth gap and highlights the urgent need for concerted efforts to bridge the equity gap.

- Financial barriers are few too many

- Escalating costs of living in BC cause roadblocks over the aspiration of parents and the future of their child’s education. Among the barriers stated by the respondents that don’t have an RESP, financial challenges take front seat.

- About 79% of BC parents without an RESP cite financial barriers as the main challenge for not opening an account.

- As high as 62% of BC parents struggle to find money to contribute towards RESPs due to other household costs, whereas 52% state other financial goals as a higher priority and 51% are unable to find spare cash for an initial RESP deposit

- Among them, low-income households are the hardest hit; 66% are unable to contribute towards RESPs due to high costs of living

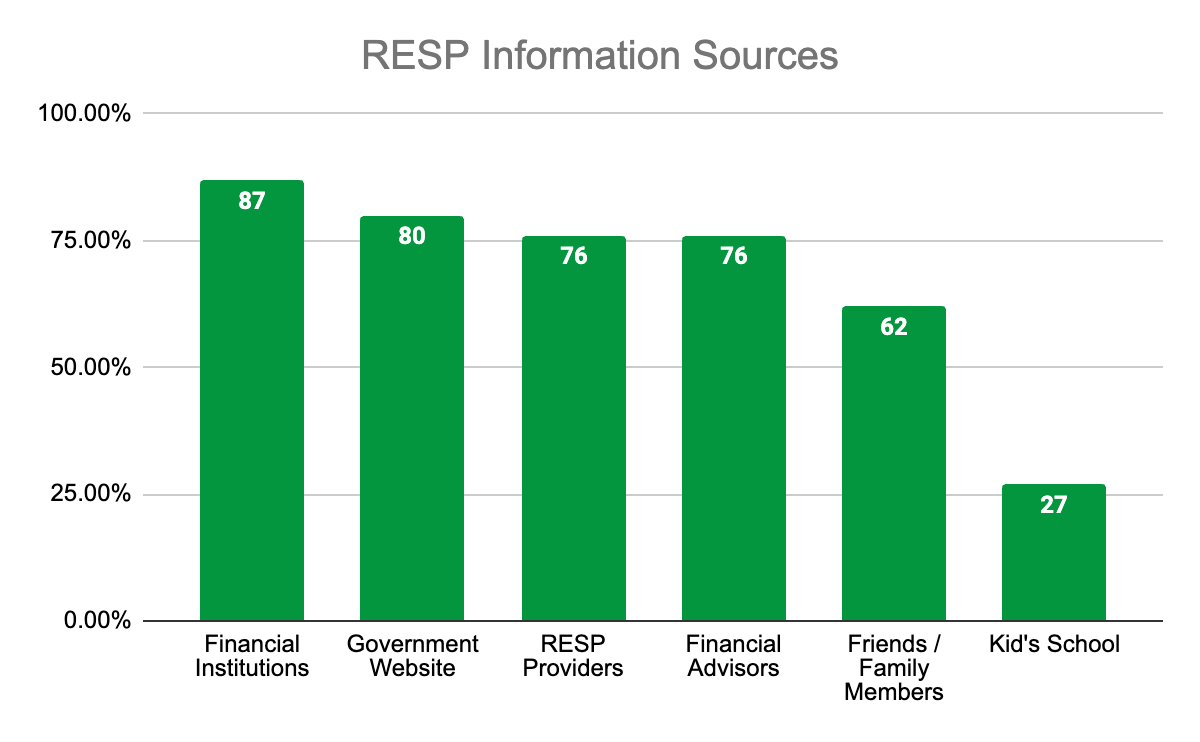

- BC parents look to trusted authorities for information; financial institutions to step up role

- BC parents are drawn to trusted authorities for details on RESP

- About 87% turn to financial institutions, underscoring the pivotal role financial institutions play in shaping the decisions of BC parents regarding their children's education investments

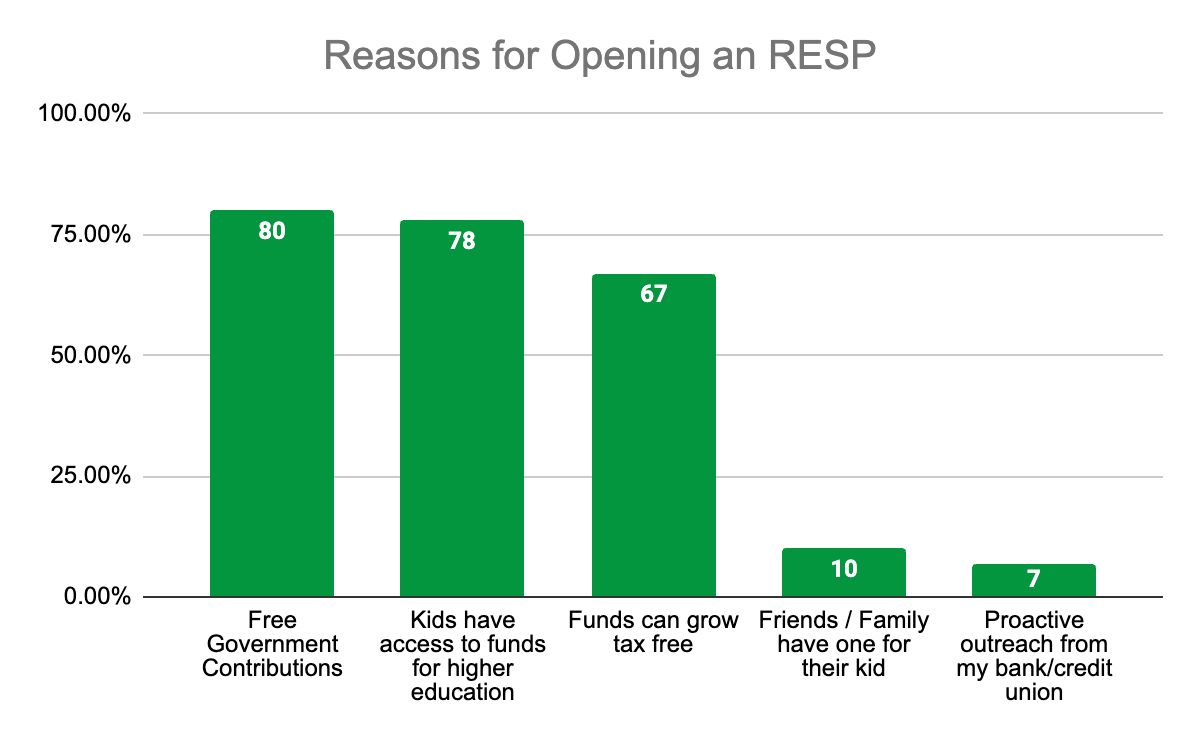

- While financial institutions assume a major role as a reliable source of information, only a mere 7% of BC parents reported that their decision to open an RESP account was prompted by proactive outreach from their financial institutions. There is a significant opportunity to enhance this engagement and bridge the gap

- Government as an enabler for accessible education

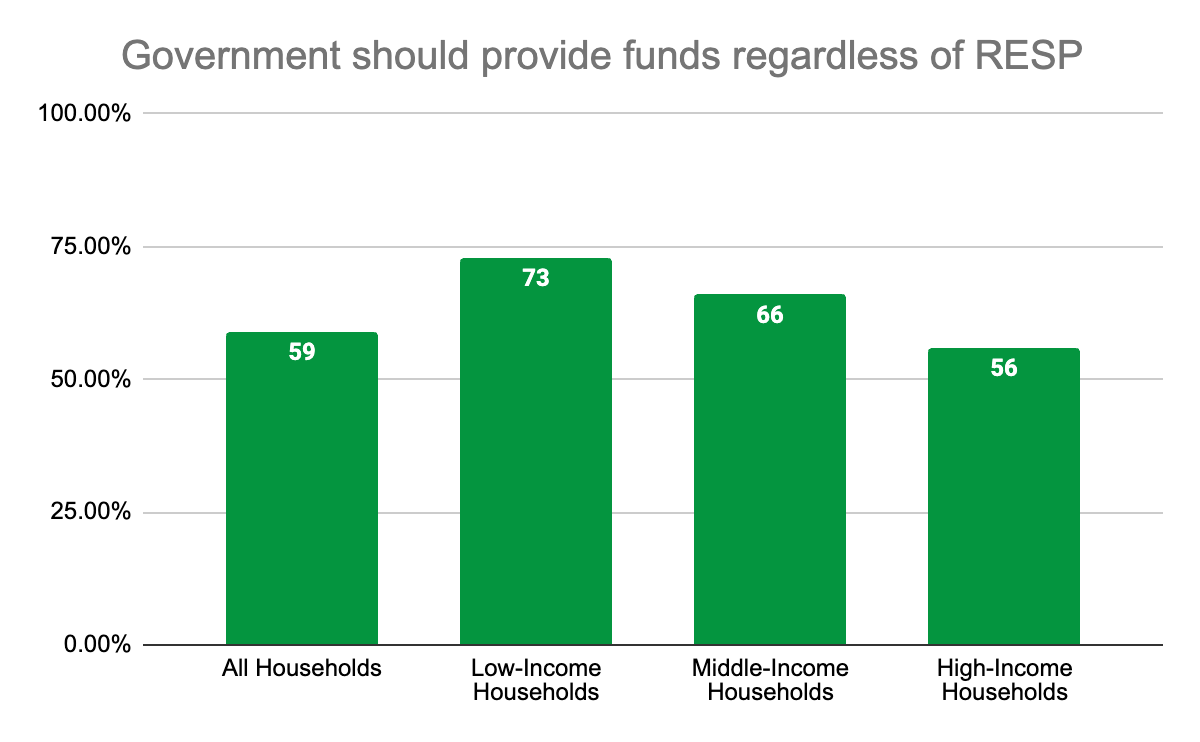

- Consumed by the heavy administrative work and a bureaucratic process of opening an RESP, 59% of BC parents with an RESP agree that the government should provide funding for every child regardless of an account set up.

- This is a striking ask from low-income households at 73% who want to see this change implemented.

- In contrast, only 56% of high-income households care about this change in regulations, again indicating a divide between the needs of low- and high-income households in BC.

- The government has the opportunity to simplify the process, or even better yet, provide parents with the grant independent of their decision to open an RESP account for their child.

- Such an intervention can significantly enhance the accessibility of educational savings instruments, ensuring that financial barriers do not impede a child’s higher education trajectory.

Media contact:

CSCU@yulupr.com

604.558.1656

About the research:

- Community Savings commissioned Angus Reid to conduct an online survey of 810 BC parents with children in the household aged 18 or under. It was completed between July 5-10, 2023, using the Angus Reid Forum.

- High-Income Households earn over $100,000. Low-Income Households are identified as those with a household income below $50,000

About Community Savings:

Community Savings Credit Union is driven by its purpose to unite working people to build a just world. As BC’s largest fully unionized credit union, Community Savings provides best-in-class personal and business banking and advocates for workers’ rights and mental health.

Community Savings operates seven branches across the Lower Mainland and Victoria. It lives by its labour values, from being the first financial institution to become a Living Wage employer in 2010 to winning the 2022 BCBusiness Business of Good Workplace Wellness Award for its innovative staff wellness programs. For more about Community Savings, visit www.comsavings.com.

About Angus Reid:

Angus Reid is Canada’s most well-known and respected name in opinion and market research data. Offering a variety of research solutions to businesses, brands, governments, not-for-profit organizations and more, the Angus Reid team connects technologies and people to derive powerful insights that inform your decisions. Data is collected through a suite of tools utilizing the latest technologies. Prime among that is the Angus Reid Forum, an opinion community consisting of engaged residents across the country who answer surveys on topical issues that matter to all Canadians.